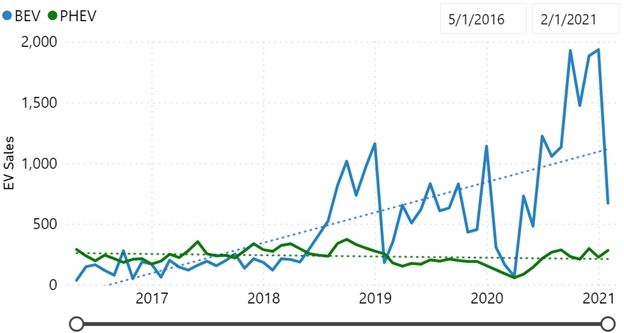

Source: EV Hub

State EV policy activity has skyrocketed over the last five years with more than twice as many EV policies enacted in 2020 compared to 2015. The effects of these policies on the EV market range from stimulating adoption, like vehicle rebates, to punitive, like some annual EV registration fees. Passenger EV sales in the United States were down three percent in 2020 compared to 2019, largely as a result of pandemic challenges including reduced new vehicle demand and production challenges. Despite this dip in 2020, the doubling of annual policies related to EVs coincides with a 2.7 times increase in EV sales compared to 2015.

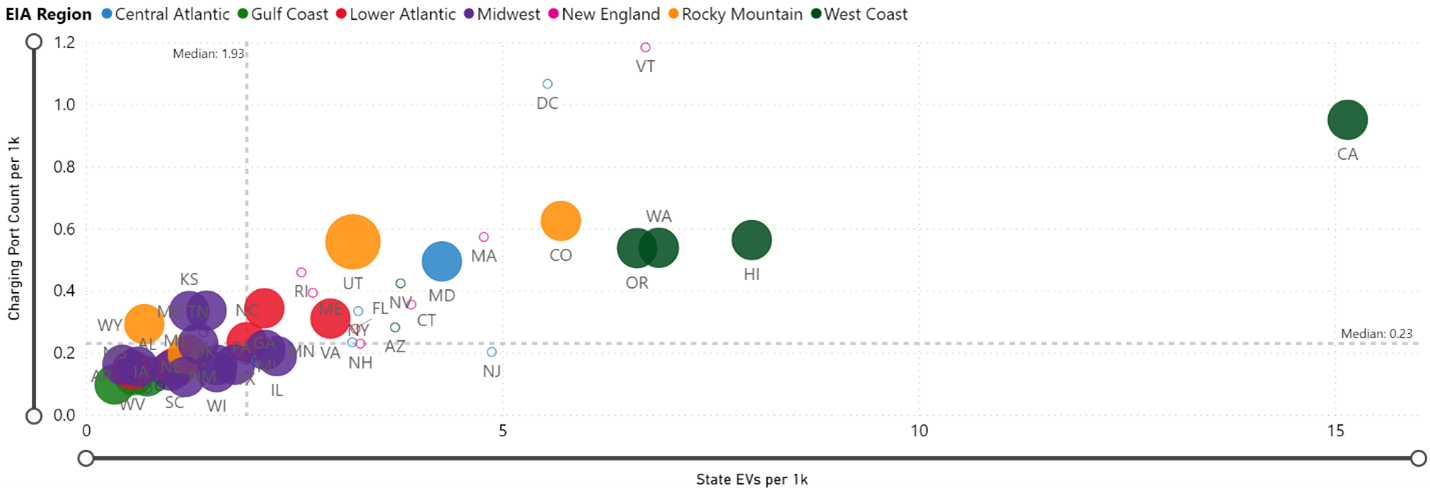

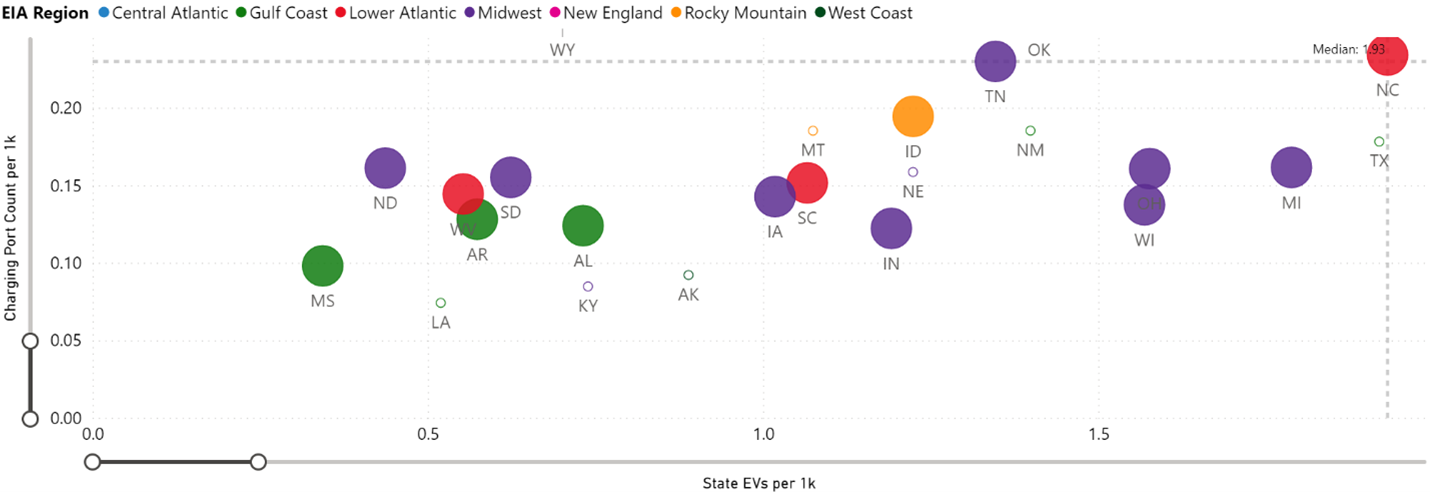

The EV Hub is providing a closer look at how policy influences EV adoption and EV charging deployment in the new State Policy Dashboard. This revamped tool takes all of the best parts of the EV Hub’s public policy dashboards and combines them to provide unique insights. For example, the “Policy Analysis” page allows you to view EV and charging deployment per capita for states that have and have not enacted certain policies to explore how a policy may have affected the market.

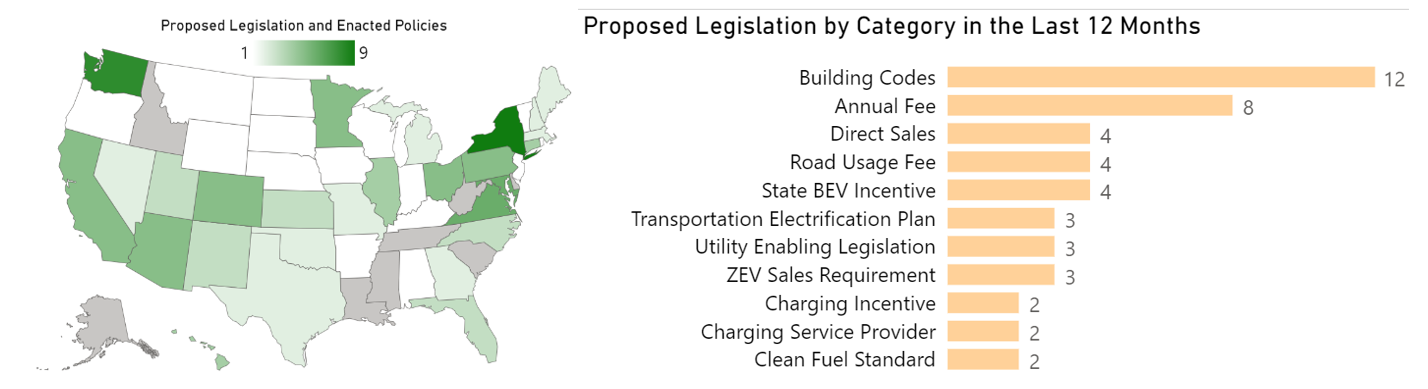

The dashboard shows that states that have adopted EV rebates or tax credits tend to have higher per capita EV and EV charging deployment. Conversely, most states with the lowest levels of per capita EV and charging deployment have implemented annual registration fees. In fact, 70 percent of states in the lower half of EV and charging deployment per capita have an EV fee compared to 44 percent in the upper half of states. These fees are unlikely to generate significant revenue for these states in the near term and have been seen as punitive in some cases.

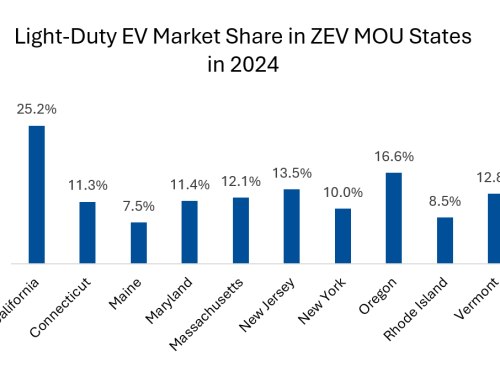

The dashboard also allows you to track legislation as it moves through different state legislatures. Virginia is an example of an EV market on the rise with three recent supportive policy actions tracked on the dashboard. Virginia is the only state that has enacted an EV rebate program thus far in 2021. If enacted, Virginia would be the only state in the Southeast to actively offer such a policy. Virginia also became the 13th state to join the ZEV program in March 2021. All of this will likely have a positive impact on EV sales and other key metrics in the state, which currently ranks 15th out of all states in all-time EV sales.

Nationwide, transportation electrification targets are the most common policy that has been enacted in the last 12 months with 16 states taking this approach. Building codes are the most common legislation that has been proposed with 12 new policies seeing some form of action in the last year. The EV Hub relies on its users to make sure the most recent developments are being surfaced. If you are aware of any updates that we have missed, do not hesitate to reach out to us here. This is the first of two data stories focused on the new State Policy Dashboard. Stay tuned for the second one focused on the public requests and funding aspect of this tool.