Source: EV Hub

We just published our Q4 Quarterly Review (covering October, November, and December 2022). The slides bring together key developments from the EV market and policy space. Here are four stories that caught our eye:

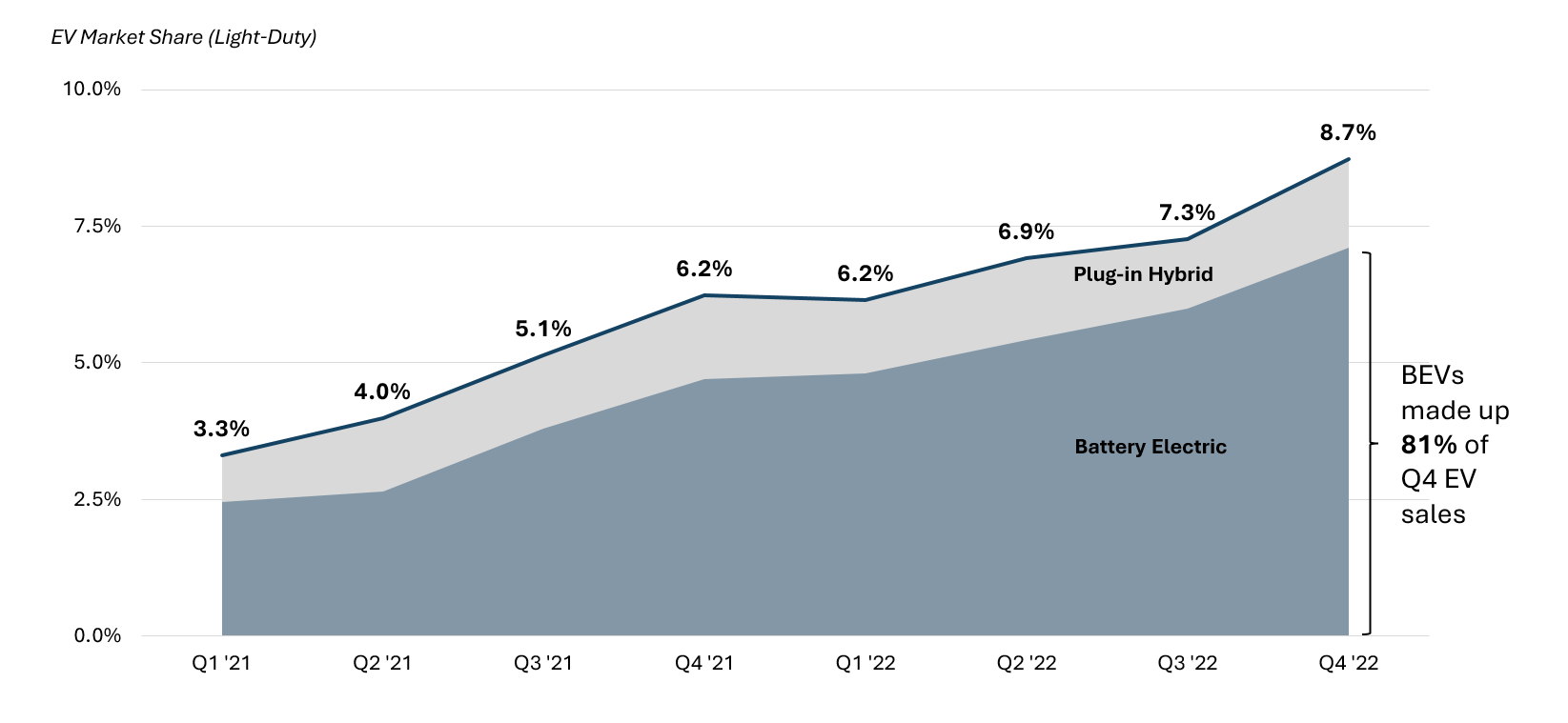

U.S. EV Market Share Continued to Climb

The EV light-duty market share in the United States for Q4 was 8.7 percent, nearly sneaking into the double digits. At this point it’s not nearly as surprising, but certainly worth celebrating and affirms that the transition to EVs is here to stay. Q4 of 2022 racked up record-breaking sales – 285,000 to be exact. This is a 48 percent year-over-year growth from Q4 of 2021, which brought in about 193,000 sales. The data also tells us that battery electric vehicles (BEVs) are rising in popularity, making up 81 percent of EV light duty sales during Q4 (compared with 70 percent for all time sales).

Looking at Q4 company sales data from a birds-eye view, there are two items that are particularly noteworthy. First, Ford broke new ground representing 8 percent of Q4 EV sales. Not only was this Ford’s best quarter in terms of EV sales, but the company is securing its spot as second to Tesla in the EV market with about 23,000 sales during the quarter. In addition to this impressive feat, Ford recently announced plans to significantly boost production in 2023. Second, Hyundai sales continued to dip after an impressive growth in the first half of 2022. We wrote about the automaker’s flux in sales in a previous digest. Hyundai is not the only automaker that stalled in 2022. According to this recent analysis, other big automakers like Honda and Toyota fell short of their 2021 sales totals as well.

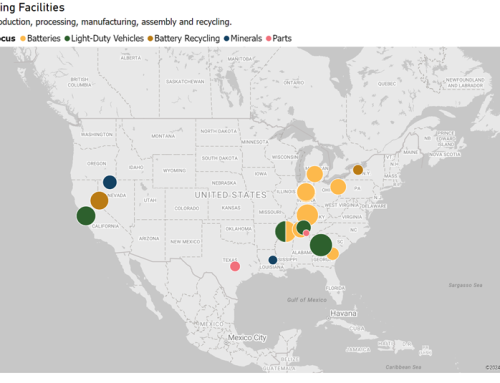

EV and EV Battery Manufacturing Investments Tripled from Year Prior

Last quarter saw $23.3 billion in total announced investment, compared to just $6.9 billion the year prior. Investments for battery manufacturing dominated Q4 of 2022 with upwards of $21 billion announced.

The largest investment we saw during this quarter came from Honda and LG jointly investing $4.4 billion in a battery plant in Fayette County, Ohio. This investment is expected to create upwards of 2,200 jobs and produce 40 GWh of batteries annually by 2025.

Next, on December 8th, 2022, Hyundai and SK Innovation announced a $4 billion investment in Georgia to supply batteries to a nearby Hyundai Assembly plant. This project is considered “one of the largest economic development projects in the state’s history,” and will lead to an anticipated 3,500 new jobs in Bartow County.

Georgia’s neighbor, South Carolina, also saw a hefty battery manufacturing investment. On December 14th, Redwood Materials announced a $3.5 billion battery recycling facility just outside of Charleston, South Carolina. Redwood’s Battery Materials Campus is expected to create more than 1,500 local jobs and will eventually produce up to 100 GWh of battery components per year.

Public Funding for Clean Transportation and Electric School Buses Announced

On October 26th, 2022, the Biden-Harris Administration announced nearly $1 billion for 389 school districts. This funding will help school districts purchase nearly 2,400 electric school buses.

In November, New York announced the winners of the Clean Transportation Prizes. We provided the full rundown in a digest here. And before the end of the quarter, Massachusetts awarded nearly $10 million for electric school buses to six entities. This funding stems from a larger $100 million commitment to clean energy and transportation in the state.

Approved Utility Investments Amount to $1.4 Billion in Q4

Of that investment, nearly 70 percent was approved for California transportation electrification programs. The California Public Utilities Commission approved $1 billion in rulemaking during Q4 for a five-year, statewide program. These funds will support a behind the meter, customer-side rebate program for light-duty charging at multi-unit dwellings (30 percent of funds), as well as a customer-side behind-the meter rebate program for MDHD vehicles (70 percent of funds) for the following utilities: Southern California Edison, Pacific Gas & Electric, San Diego Gas & Electric, Pacific Power, and Liberty Utilities. Additionally, 65 percent of the funds are to be allocated to underserved communities.

View the full Q4 Quarterly Review here.