Introduction

The electric vehicle (EV) market is growing rapidly, with vehicle and battery manufacturers nearly $1.2 trillion globally in the transition from gas-powered to EVs. Of this total, $312 billion is expected to be invested into U.S. manufacturing, with nearly 71 percent of that amount – $223 billion – already allocated to specific facilities and initiatives.

Landmark climate legislation in the United States, including the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), has helped to attract global investment and established the United States as a hub for EV and battery manufacturing. Of the $223 billion that has already been allocated to specific U.S. EV manufacturing facilities and initiatives, $148 billion (66 percent) was announced since the passage of the IIJA in November 2021.

As the industry enters a critical period in the EV transition, Atlas Public Policy has analyzed the latest press releases, company earnings reports, and public resources to provide insights into global investment in the EV manufacturing and how the investment environment has evolved since our last report on this topic in January 2023.

U.S. Holds the Lead in Global EV Investment Against Fierce Competition

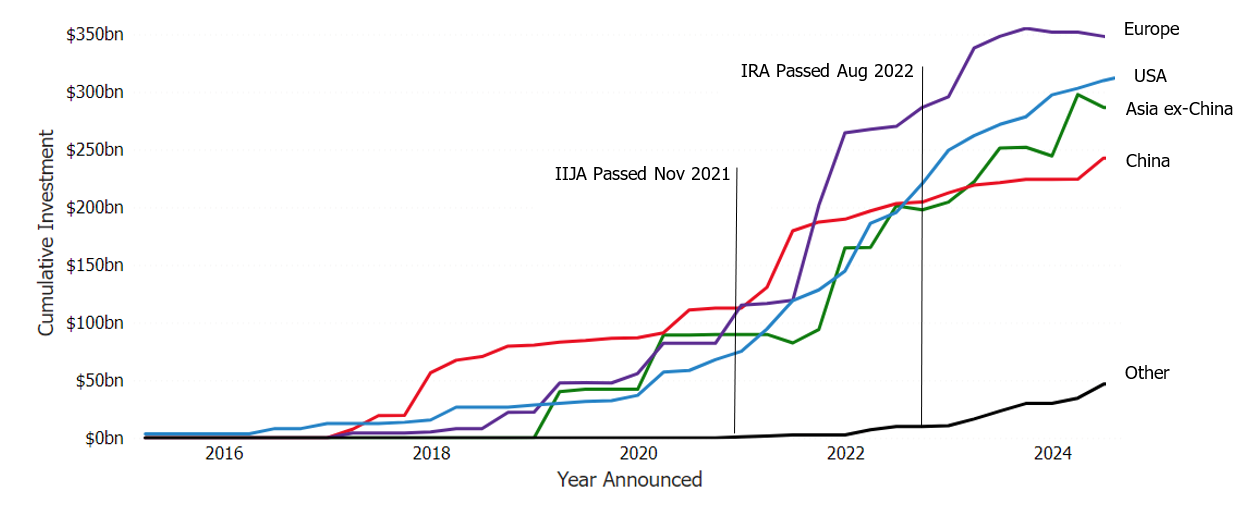

Globally, automakers and EV battery manufacturers have thus far committed to invest $1.2 trillion in the EV transition, an increase of $261 billion since January 2023. This includes nearly $312 billion in investment for EV and EV battery manufacturing in the United States, $346 billion in Europe, and $243 billion expected to flow to China. Figure 1 depicts the rapid rise in U.S. EV investment alongside other regions.

Figure 1: Cumulative Investment Commitments by EV and EV Battery Manufacturers, by Region1

This figure depicts cumulative announced investment by the region where investment is expected to be made. Total tracked investment includes a) investments allocated to EV-specific manufacturing facilities and/or initiatives, b) capital dedicated towards electrification from automakers, and c) capital raised through venture capital, public offering, bonds, loans, or other financial mechanisms from EV-only manufacturers and EV battery manufacturers or recyclers. Investments that are not specified for a specific country are assumed to occur in the investor’s home country. Source: Atlas EV Manufacturing Investments Dashboard

Recently, some U.S. automakers have altered their investment timelines. For instance, in April 2024, Ford announced plans to delay production of two new electric models, a pickup truck and an SUV, citing market uncertainties and shifting its focus towards hybrid production. The automaker also announced its decision to build more gas-powered Super Duty trucks at its Oakville Assembly Complex in Ontario, Canada, a facility previously designated for expanded EV production. General Motors also plans to delay EV production in 2024. Tesla announced it would lay off nearly 10 percent of its global workforce to “cut costs and increase productivity” and subsequently cut prices for some of its most popular models in the United States, China, and Germany.

While some U.S. automakers have walked back initial ambitions, the global industry has continued to move ahead in the past year:

- Hyundai in June 2023 announced a new strategy called “Hyundai Motor Way” to accelerate its electrification transition by investing $27.8 billion over the next ten years. In March 2024, the company announced an additional investment of nearly $50 billion in Korea over the next three years to 2026, with plans to hire 80,000 people. These investments bring Hyundai’s total committed EV investment to nearly $165 billion across multiple markets.

- Volkswagen in March 2023 announced an additional $33.3 billion for electrification in Europe through the end of 2027; bringing its total EV investment commitments to $136 billion.

- Suzuki in January 2023 announced it will invest nearly $15 billion to electrify its product range by 2030, including $3.5 billion for the development and production of EV batteries.

- Skoda in March 2023, announced plans to accelerate EV deliveries in Europe to more than 70 percent and invest over $6 billion in electrification by 2027.

Recent national regulations, including the Environmental Protection Agency’s light-, medium-, and heavy-vehicle emissions standards in the United States, provide greater investment certainty for automakers and ensure that the global EV market will continue to grow over the coming decade.

EV Investments Land in the United States as Companies Move from Commitments to Implementation

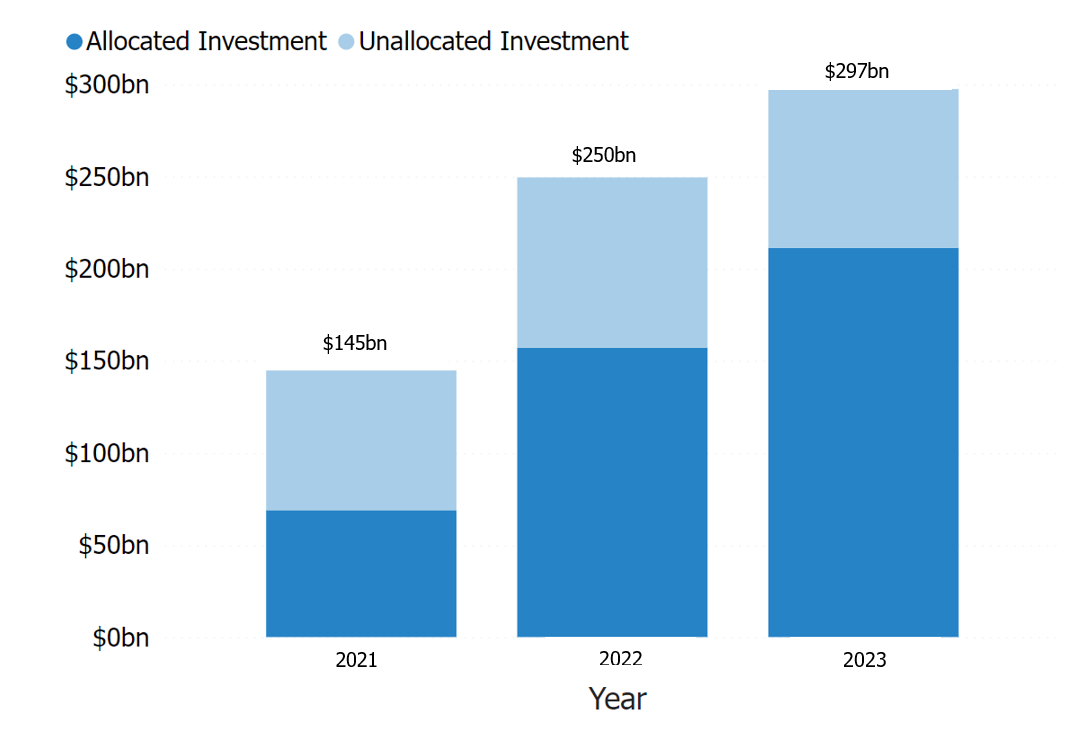

Of the $312 billion expected to be invested into U.S. EV and EV battery manufacturing, $223 billion has been allocated to specific facilities or initiatives. This marks an increase of nearly $66 billion since our last report in January 2023, as companies work to turn their commitments into on-the-ground reality.

Battery manufacturing accounts for $133 billion (59 percent) of the allocated investment in the United States, $70 billion (32 percent) is allocated for EV manufacturing, and $21 billion (9 percent) is directed towards production of components further down the supply chain, such as EV parts and critical minerals. Although domestic automakers have provided the largest investments flowing to the United States, foreign companies are increasingly viewing the United States as an attractive destination for EV investments, spurred by robust federal incentives for domestic manufacturing and growing demand from customers. Figure 2 shows the growth of cumulative allocated investments over time.

Figure 2: Cumulative Investment Commitments for EV and EV Battery Manufacturing in the United States

Source: Atlas EV Manufacturing Investments Dashboard

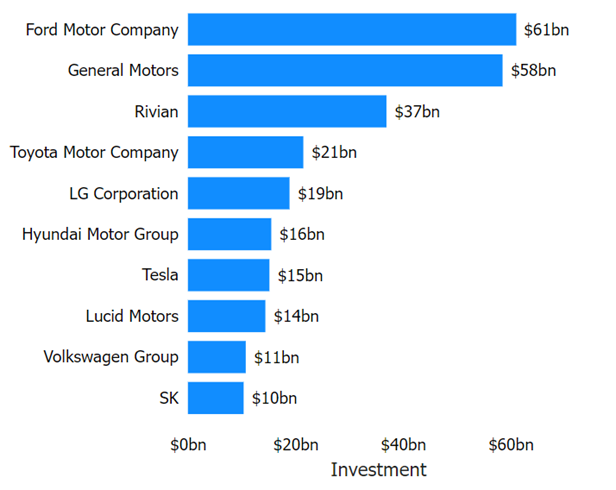

In 2023 alone, companies announced $54 billion of investments in manufacturing facilities in the United States. Table 1 provides the largest commitments made in 2023. Figure 3 depicts the ten companies that have made the largest commitments in the United States to date.

Table 1: Leading U.S. EV and EV battery manufacturing commitments in 2023

|

Company |

Investment |

State |

Facility Type |

|

Toyota |

$10.1 billion |

NC |

Battery manufacturing |

|

$1.3 billion |

KY |

EV production |

|

|

$1.4 billion |

IN |

EV production |

|

|

Stellantis |

$5 billion |

IN, IL |

EV and EV Battery Manufacturing |

|

LG Energy Solution

|

$4.1 billion |

AZ |

Battery manufacturing (supported by IRA tax credits) |

|

$3 billion |

MI |

Battery manufacturing |

|

|

Hyundai |

$3.2 billion |

GA |

Battery manufacturing |

Figure 3: Top 10 Companies by Committed Investment in U.S. EV Manufacturing and EV Battery Manufacturing to Date

Total tracked investment includes a) investments allocated to EV-specific manufacturing facilities and/or initiatives, b) capital dedicated towards electrification from automakers, and c) capital raised through venture capital, public offering, bonds, loans, or other financial mechanisms from EV-only manufacturers and EV battery manufacturers or recyclers. Source: Atlas EV Manufacturing Investments Dashboard

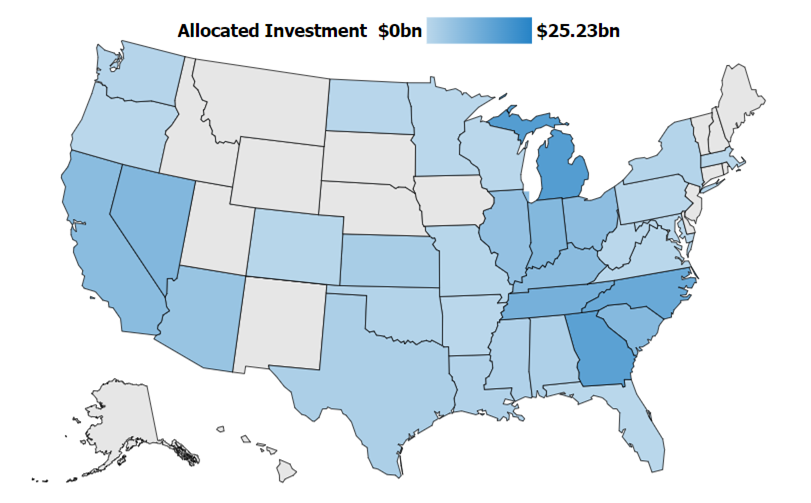

The Southeast, including Alabama, Georgia, North Carolina, South Carolina, and Tennessee, has emerged as a major hub for EV manufacturing in the United States. Across these states, companies are investing nearly $77 billion in EV manufacturing facilities. The companies expect these investments to create 74,000 jobs. Georgia stands out in this region, attracting more than a third of these investments, amounting to just over $23 billion. A significant portion of this funding is dedicated to battery manufacturing, positioning Georgia as a leader in the EV battery sector.

Meanwhile, the Midwest is also experiencing substantial growth in EV manufacturing, signaled by $56 billion in investments and 54,000 new jobs expected to be created in the region. Michigan is set to gain $25 billion, or nearly half of that investment, including significant commitments from automotive giants such as GM and Ford; further solidifying Michigan’s pivotal role in the nation’s historic automaking and evolving EV landscape. Lagging U.S. regions are also beginning to pick up the pace: Arizona is emerging as a hotspot for EV manufacturing in the Southwest: to date the state has attracted about $8 billion in private sector investment for EV manufacturing.

Figure 4: Allocated EV and EV Battery Manufacturing Investments by State

Allocated facility investments refer to publicly announced investments in a specific facility for the manufacturing of EVs and/or EV batteries. Source: Atlas EV Manufacturing Investment Dashboard

Unprecedented Federal Support Spurs Private Sector Investment

Since the passage of the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), the federal government has awarded over $23 billion in loans and grants to support EV and EV battery manufacturing in the United States, excluding the significant manufacturing tax credits.

Much of this funding has been distributed through the Advanced Technology Vehicle Manufacturing Loan Program. Notable awards include a conditional commitment for a loan of up to $9.2 billion to BlueOval SK LLC by the Loan Programs Office (LPO). This loan will facilitate the construction of three manufacturing plants—one in Tennessee and two in Kentucky—to produce batteries for Ford Motor Company’s future Ford and Lincoln EVs. Collectively, these plants are projected to generate over 120 gigawatt hours of U.S. battery production annually. The project is expected to create approximately 5,000 construction jobs in Tennessee and Kentucky and 7,500 operational jobs once the plants are fully operational. Additionally, the LPO made a conditional loan commitment of $2 billion to Redwood Materials for the construction and expansion of a battery materials campus in McCarran, Nevada.

Battery manufacturing has also received significant boosts from other federal investment programs. For instance, $2.5 billion has been awarded under the Battery Materials Processing and Battery Manufacturing Recycling grant programs. This funding aims to support new and expanded commercial-scale domestic facilities to process lithium, graphite, and other essential battery materials. Table 2 breaks down the funding awarded from IIJA and IRA for EV and EV battery manufacturing by program.

Table 2: Funding Awarded from IIJA and IRA for EV and EV Battery Manufacturing, as of July 2024

|

Program |

Number of Facilities |

Funding Awarded |

|

Advanced Technology Vehicle Manufacturing (Loans) |

16 |

$19 billion |

|

Battery Materials Processing and Battery Manufacturing Recycling (Grants) |

18 |

$2.5 billion |

|

Domestic Manufacturing Conversion Grant Program (Grants) |

11 |

$1.7 billion |

|

Advanced Energy Manufacturing and Recycling Program (Grants) |

1 |

$100 million |

|

Electric Drive Vehicle Battery Recycling and Second Life Applications (Grants) |

5 |

$40 million |

This table shows the cumulative amount of funding awarded for EV and EV battery manufacturing from IIJA and IRA, excluding tax credits. Source: EV Jobs Hub

In addition, a robust system of U.S. tax credits is attracting unprecedented investment in U.S. jobs, parts and facilities, supporting and attracting a consumer base to purchase U.S. made products. In particular, the clean vehicle tax credit (30D), which offers a $7,500 tax credit to consumers purchasing vehicles that meet certain criteria, has opened the door for more American consumers to purchase EVs. In June 2024, the IRS announced that consumers had claimed $1 billion in tax credits between 30D and the Used Clean Vehicle Credit (25E), which provides up to $4,000 for a qualifying used EV. Since January 2024, 125,000 consumers had purchased new EVs and 25,000 had purchased used EVs. Currently, 39 vehicles are eligible for the 30D tax credit.

Moreover, the Alternative Fuel Infrastructure tax credit (30C), which supports the construction and installation of chargers and other infrastructure, has become increasingly available to American households. Recent Atlas Public Policy analysis of 30C-eligible census tracts indicates that upwards of 202 million individuals are eligible for the 30C tax credit.2 However, Treasury and the IRS still need to provide additional definitions and finalize guidance before individuals and businesses can determine how much credit they can access for planned projects and have certainty in investment decisions.

On the manufacturing front, the Qualifying Advanced Energy Project Credit (48C) has attracted companies looking to invest in EV and battery manufacturing in the United States. Eight facilities have received approximately $565 million in total 48C tax credits,3 provided by IRA funding that extended the program. Notably, companies are not required to publicly disclose their credit amounts, so any known amounts are self-reported by the facility.

Conclusion

Despite some recent rollbacks in ambition, the United States’ EV manufacturing sector continues to show significant growth. Spurred by emissions standards, federal and state incentives, and growing consumer demand, global automakers and battery manufacturers continued to roll out investments in manufacturing facilities across the United States throughout 2023 and the first half of 2024. The southeast of the country has emerged as a major hub for EV manufacturing, while the Midwest and Arizona have also drawn significant investment.

[1] While every effort has been made to track investment flows globally, we note that investments particularly by smaller local companies may not be fully reflected here, especially in cases where reporting is only in languages other than English. [2] Based on Atlas analysis of 30C eligible census tracts provided by ANL and population data from the U.S. Census [3] EV Jobs Hub