Source: Q1 Quarterly Review

Hot off the press, we published our Q1 Quarterly Review, which summarizes key electric vehicle (EV) policy and market developments in January, February, and March of 2024. As a reminder, we publish slide decks summarizing developments for each quarter here. Here’s three takeaways.

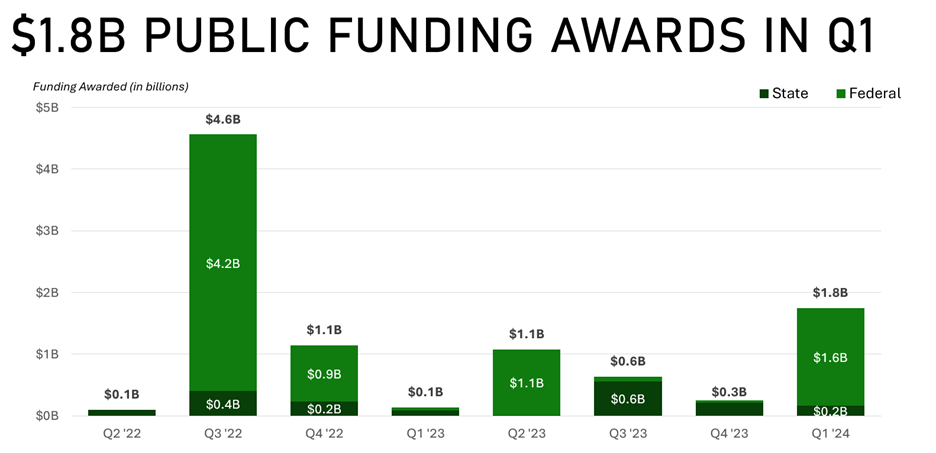

Nearly $1.8 billion in public funding awarded for EV charging

During Q1, federal funding for EV charging significantly ramped up. Notably, in January, the Environmental Protection Agency’s (EPA) Clean School Bus Program awarded nearly $1 billion across 230 school districts for the purchase of 2,700 clean school buses, with 99 percent of funds going toward the purchase of electric school buses.

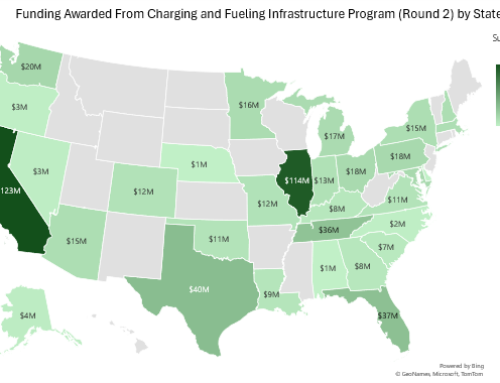

Shortly after, the Federal Highway Administration (FHWA) announced its first funding package through the Charging and Fueling Infrastructure (CFI) discretionary grant program, awarding nearly $623 million across 47 charging and fueling infrastructure projects. During this first round, 84 percent of the funding, or $524 million, was awarded to EV charging projects, while the remaining 16 percent went to hydrogen fueling projects.

CFI’s sister program, the National Electric Vehicle Infrastructure (NEVI) program, also saw significant momentum in Q1. Ten states awarded nearly $115 million in funding for private entities to build out EV chargers along key highway corridors.

On the state level, the Washington State Electric Vehicle Charging Program awarded $85 million in grants to nonprofits, utilities, tribes and public agencies. This funding will support more than 4,700 new Level 2 EV charging stations and 271 fast charging stations.

EPA finalizes emissions standards for light, medium and heavy-duty vehicles

In March, the EPA finalized standards to regulate the emissions of new light, medium, and heavy-duty vehicles sold in the United States, enforcing the strongest-ever vehicle pollution standards.

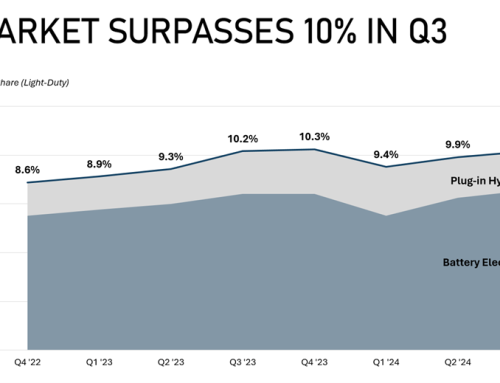

For light-duty vehicles, battery electric and plug-in hybrid electric vehicles could make up 32 percent of all new vehicle sales in model year 2027, increasing to 69 percent by model year 2032. For commercial vehicles, it is anticipated that, by 2032, zero-emission commercial vehicles will comprise between 25 percent and 60 percent of new vehicle sales according to the EPA’s regulatory analysis.

$145 million of new utility investment filed in Q1

On January 11, 2024, DTE Energy submitted its Transportation Electrification Plan (TEP) 2025 – 2028 to the Commission for approval, proposing $145 million in new investment for EV charging programs. This TEP plan supports approximately 18,250 Level 2 charger ports and 1,040 direct-current fast charger ports. On-route charging makes up the biggest category of investment at 30 percent, followed closely by fleets at 29 percent, multi-unit dwellings at 22 percent, and single-family homes at 19 percent. Half of DTE’s proposed rebate investment of $125 million is slated to promote equity in EV and EV infrastructure access. The remaining $20 million is slotted for program support such as administration and reporting.

View the Q1 Quarterly Review here.