The Environmental Protection Agency (EPA) is continuing its historic momentum enforcing vehicle pollution standards in the United States, this time focusing on commercial trucks and buses.

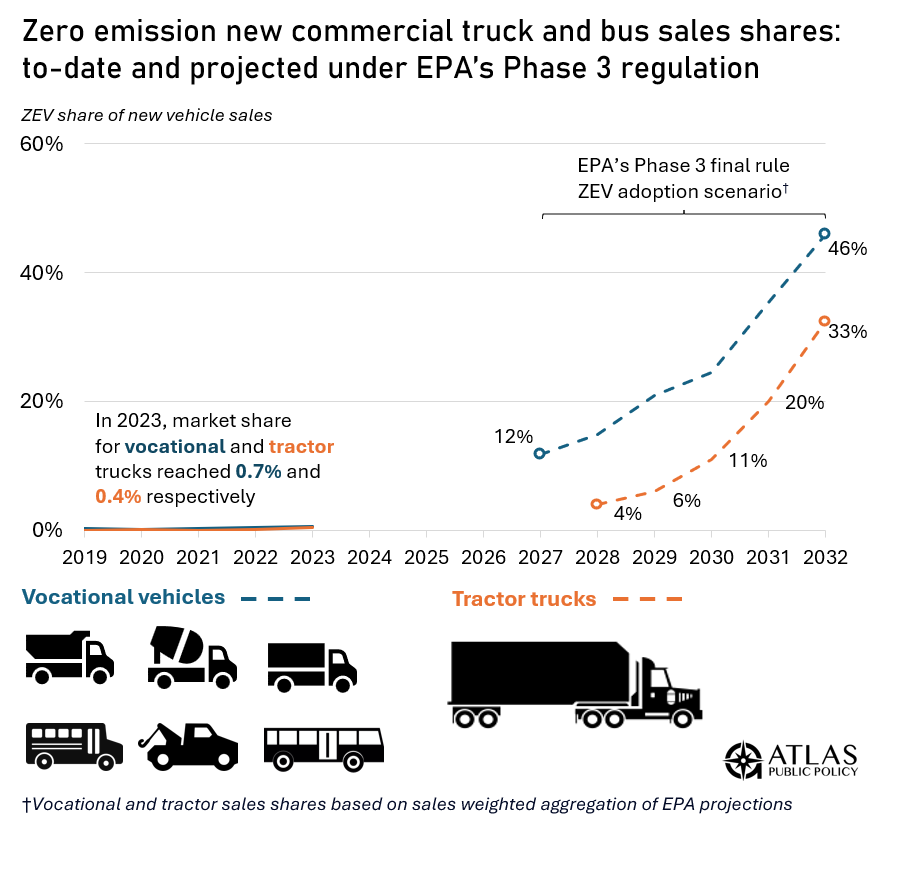

On Friday morning, the EPA published its final ‘Phase 3’ standards to regulate the greenhouse gas (GHG) emissions of new on-road commercial vehicles sold in the U.S. Beginning in model year 2027, manufacturers of heavy-duty trucks and buses will need to comply with these new GHG requirements through increasing the fuel efficiency of engines and vehicles, as well as rapidly increasing the sale of zero emission vehicles (ZEVs). These regulations come less than two weeks after the EPA announced the final rule for light- and medium-duty vehicles in the U.S., which could lead to battery electric and plug-in hybrid vehicles making up 69 percent of new light-duty vehicle sales by 2032.

The Phase 1 and 2 regulations (together, covering model years 2014 to 2026) were almost exclusively designed with the expectation that internal combustion engines (ICEs) would be the dominant technology in the commercial vehicle market. Phase 3, however, is expected to be much more transformative in terms of compelling manufacturers to produce and sell an increasing share of zero emission trucks and buses. As such, the Phase 3 regulations are expected to mark a significant turning point in the heavy-duty vehicle industry. According to EPA administrator Michael Regan, the new rule is “the strongest national greenhouse gas standard for heavy-duty vehicles in history.”

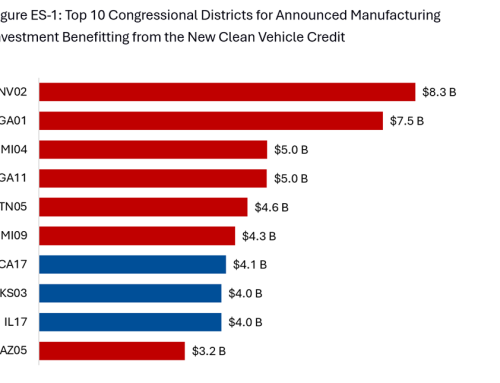

Like the light-duty rule, manufacturers are given considerable flexibility with how they can meet these standards, but the EPA is projecting that ZEVs will play a critical role with compliance. According to the EPA’s regulatory analysis, it is anticipated that by 2032, zero-emission commercial vehicles will comprise between 25 percent and 60 percent of new vehicle sales, depending on the vehicle category.

For vocational vehicles, which encompass a broad spectrum of sizes and configurations ranging from delivery trucks to parcel vans to buses, we estimate that zero-emission vehicles will represent 46 percent of sales by 2032. As for tractor trucks, commonly referred to as ‘semi-trucks’ or ‘big rigs’, we estimate that 33 percent of new vehicle sales will need to be combustion-free by 2032. These estimates are based on sales weighting of EPA’s projections for ZEV uptake of three regulatory subcategories for vocational vehicles (light heavy-duty, medium heavy-duty and heavy heavy-duty vehicles) and two subcategories for tractor trucks (day cabs and sleeper cabs). These projections carry significant implications for manufacturers and their supply chains, dealers, service networks, and notably, for truck and bus fleets.

The Biden-Haris administration has ambitious goals for the future of medium- and heavy-duty (MDHD) vehicles in the U.S. In particular, the administration envisions MDHD vehicles making up 30 percent of all vehicle sales by 2030, and 100 percent by 2040.

How much more zero-emission truck and bus manufacturing capacity is needed?

In December 2023, Atlas Public Policy, in partnership with the International Council on Clean Transportation (ICCT), assessed the current and planned production capacity for class 4-8 commercial ZEVs based on company press releases and news sources.

To recap, Atlas identified 43 commercial vehicle manufacturing facilities across the U.S., of which 37 can currently produce ZEVs. Cumulatively, these 37 “ZEV-capable” facilities have an annual production capacity of 10,000 ZEVs, and 179,000 vehicles with an internal combustion engine. In addition, heavy-duty vehicle manufacturers have announced plans to invest over $6.5 billion to increase production capacity by 106,000 vehicles per year.

The analysis found that if all the production capacity at facilities capable of producing both gas-powered and ZEV heavy-duty vehicles was dedicated exclusively to ZEVs, existing manufacturers could produce more than 175,000 heavy-duty ZEVs per year. Combined with current and planned ZEV production capacity, this conversion could put U.S. production capacity at over 295,000 HD ZEVs per year, representing nearly 59 percent of annual heavy-duty vehicles sales.

Per the EPA’s market share projections for commercial ZEVs, Atlas estimates that manufacturers would need to sell nearly 200,000 zero-emission commercial vehicles in 2032. With the already planned ZEV production capacity of 106,000 vehicles per year, manufacturers are well-equipped to scale up ZEV production to comply with the EPA’s standards.

What investments are being made in zero-emission commercial vehicle charging infrastructure?

According to a recent data story from Atlas, an estimated $30 billion is going toward supporting truck and bus charging projects across federal, state, and local governments, in addition to investor-owned utilities and the private sector. Our new MDHD Charging Investment Dashboard lets users explore the sources, assumptions, and methods behind these investment estimates, as well as maps all of the actual MDHD charging sites Atlas could locate that are operational, in construction, or planned.

Of the $30 billion, approximately 70 percent, or $21 billion, comes from federally issued funds. The Inflation Reduction Act paved the path for significant public funding, which renewed funding for key programs such as the Low- or No-Emission Grant Program, the Clean School Bus Program, the Diesel Emissions Reduction Act, and more. Private sector investment in MDHD charging has also seen tremendous growth with companies investing an estimated $4.2 billion through the end of 2023.

In addition, the administration recently announced the National Zero-Emission Freight Corridor Strategy, which seeks to develop an expansive freight decarbonization network in the U.S. Central to this strategy is deploying MDHD charging hubs across the country by “targeting public investment to amplify private sector momentum, focus utility and regulatory energy planning, align industry activity, and mobilize communities for clean transportation.”

The significant influx of public funding, private sector investment, and supportive policy measures positions the United States as a leader in the MDHD electric vehicle industry and creates a foundation in which the ZEV adoption projections from EPA’s Phase 3 are achievable.