Source: Clean Economy Tracker

Many of the investments would not have happened without the tax credits. Ford CEO Jim Farley, for example, stated, “[m]any of our plants in the Midwest that have converted to EVs depend on the production credit. We would have built those factories in other places, but we didn’t.” He also warned that “many of those jobs will be at risk” if Congress repeals the tax incentives.

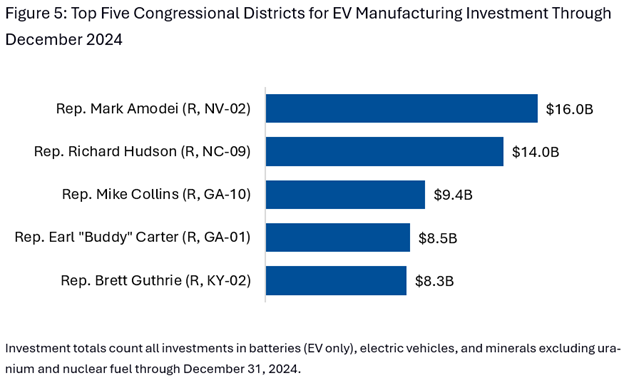

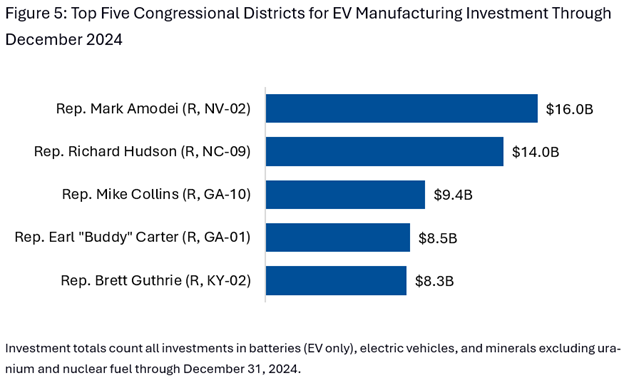

Lawmakers in Congress have also noted the benefits to the communities they represent. Representative Buddy Carter (R, GA-1) said in December 2024 that “[fellow congressional Republicans] understand that there may be parts of [the federal tax code] that can help us secure our supply chain…[W]e should look at keeping it.”

Eliminating or otherwise making the federal tax credits too difficult to attain would risk the future of transportation and energy jobs and harm the U.S. economy and national security, likely leaving the United States at a permanent disadvantage against Europe and especially China.

Click here to read the full report.