Today, my colleague Matthew Vining and I published the fifth annual Transportation Electrification in the Southeast report, produced in collaboration with the Southern Alliance for Clean Energy (SACE).

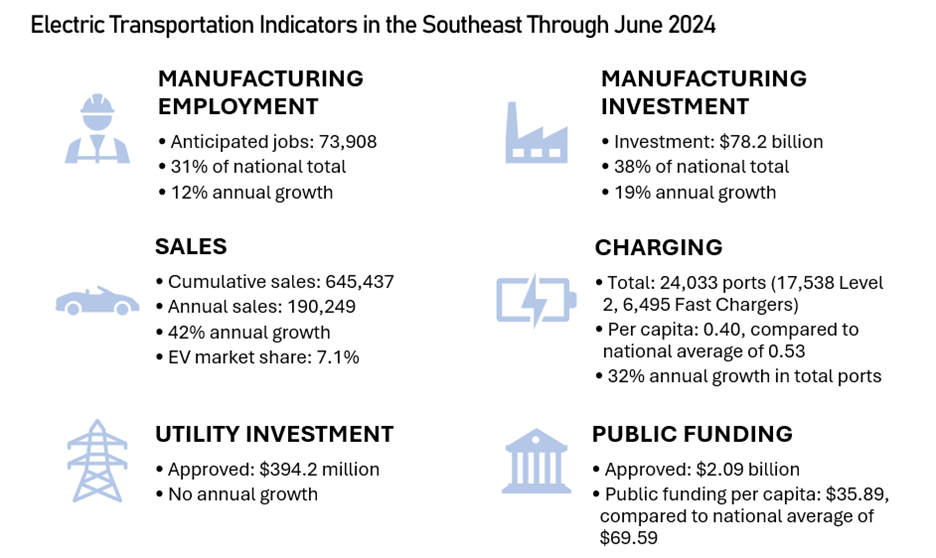

This report assesses the progress of transportation electrification across the Southeast region—Alabama, Florida, Georgia, Tennessee, North Carolina, and South Carolina—using six core metrics: EV manufacturing employment and investment, EV sales, charging infrastructure deployment, utility investment, government funding, and public policy. Drawing data from Atlas EV Hub and EV Jobs Hub as of June 2024, the report highlights six key data stories, outlined below.

-

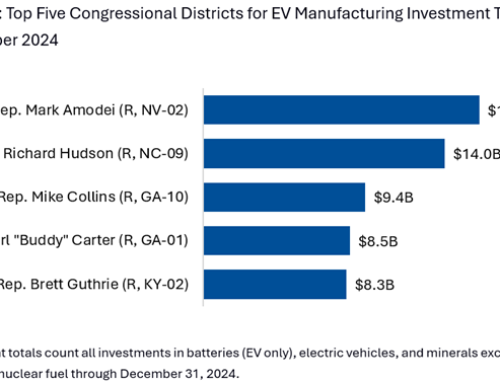

Through June 2024, the Southeast has attracted $78.2 billion in EV manufacturing investments and over 73,900 anticipated jobs across more than 100 facilities, including battery production, EV assembly, and charging infrastructure. This represents 31 percent of the nation’s total announced EV jobs (238,000) and 38 percent of the announced total EV investment ($205 billion). Southeast states account for four of the nation’s top eight EV manufacturing investment states.

-

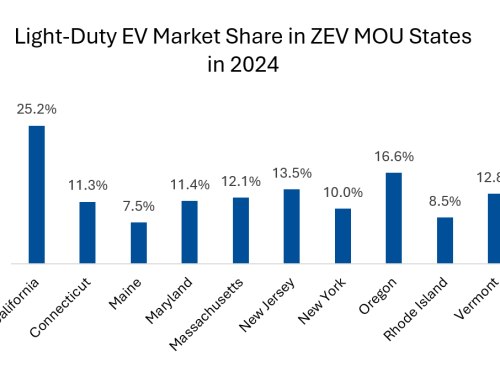

The EV market in the Southeast continues to expand rapidly, with cumulative new light-duty EV sales rising 42 percent in the past year, from 455,200 to 645,400 vehicles. As of Q2 2024, light-duty EVs accounted for 7.1 percent of the region’s market share, up from 6.2 percent in Q2 2023, with Florida leading at 8.9 percent and Georgia at 7.2 percent.

-

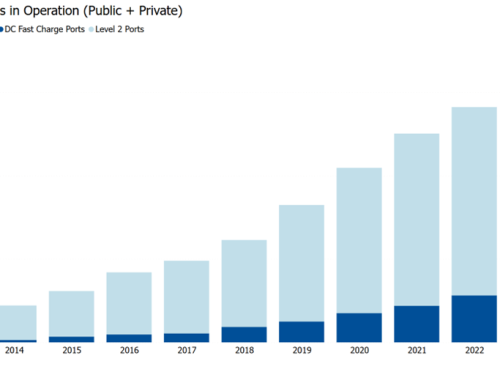

At the end of Q2 2024, the Southeast added more than 1,820 publicly accessible direct current fast chargers (DCFC), a 39 percent increase from the previous year, with Tennessee experiencing the highest growth at 60 percent. Florida, Georgia, and North Carolina led the region in both total and per capita DCFC ports, achieving per-capita counts above the national average for the first time. Additionally, Level 2 charger deployment grew by 29 percent, with North Carolina seeing the largest increase at 44 percent. Overall, the Southeast has an average of 0.40 ports (DCFC and Level 2 combined) per 1,000 people, still trailing behind the national average of 0.53.

-

Investor-owned utilities (IOUs) have secured $6.6 billion for transportation electrification nationwide, with Southeastern IOUs contributing only $394 million (6 percent of the national total). Nationally, the average approved investment per utility customer is $38, while utilities in the Southeast rank slightly lower, with Florida Power & Light and Duke Energy Florida coming closest to the average at $36 per customer each.

-

Federal funding for transportation electrification in the Southeast rose by $268 million at the end of Q2 2024, largely driven by the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), marking a 290 percent increase since the IIJA’s enactment. In contrast, state funding only grew by $1.2 million, highlighting a significant gap in electrification funding between state and federal levels. So far, state agencies and school districts in the Southeast have been awarded $405 million in Clean School Bus funds and are starting to mobilize their $680 million allocations from the National Electric Vehicle Infrastructure program to enhance EV charging networks.

-

States in the Southeast are backing the EV transition through legislative and executive actions, with North Carolina and Georgia considering additional EV fees and Florida enacting mixed-impact bills. The region is also prioritizing workforce development in EV manufacturing, automotive maintenance and service, and electrician and EV charging infrastructure through training programs and partnerships.

Read the full report here, and read an accompanying blog written by SACE.