Source: EV Hub

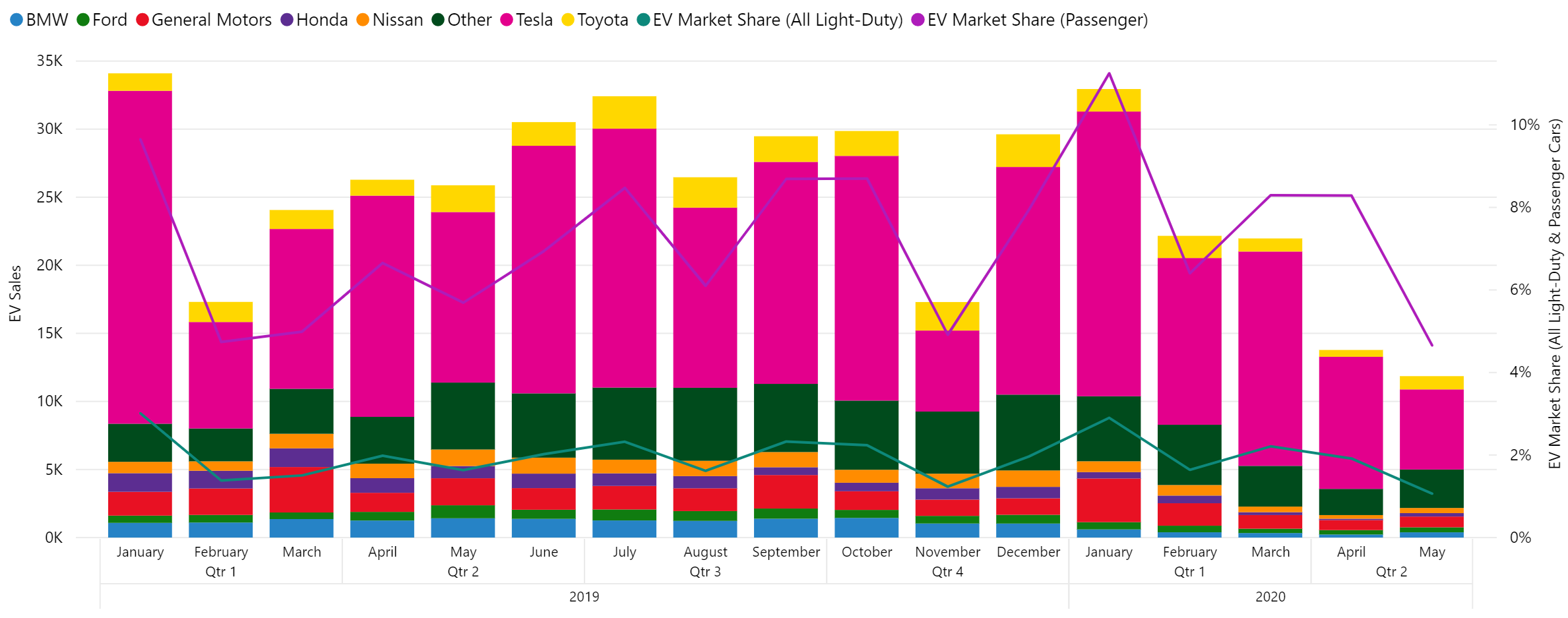

As the COVID-19 pandemic rages on, the extent of the damage to the auto market wrought by the initial outbreak of the virus continues to become more clear. Between January and May, U.S. EV sales were down 20 percent compared to 2019. After outperforming the conventional vehicle market through April, U.S. EV sales plunged by more than 54 percent in May compared to 2019. The overall auto market only saw a drop of 33 percent in May, bouncing back from a market collapse in April where sales were down by 53 percent.

Only 11,858 EVs were sold in May 2020 compared to 25,876 the year before. Tesla continues to dominate the U.S. EV market, claiming almost exactly half of the total sales. The automaker’s lead is bolstered by the introduction of the Model Y, although limited production and extended delivery timelines due to COVID-19 manufacturing shutdowns have kept sales down. In May, the Model Y was Tesla’s lowest-selling vehicle. Tesla is seeking to accelerate demand by dropping the price for the long-range version and dropping the standard-range option from their offerings.

Production and sales roadblocks aside, Tesla continues to defy the expectations of Wall Street after reporting better-than-expected global deliveries figures for the second quarter. Compared to the second quarter of 2019, Tesla’s global deliveries were down only five percent through June of this year with more than 90,000 vehicles delivered. This has reflected favorably on the company’s image in the eyes of investors and Tesla stock prices have surged to record heights in recent weeks.

The results have been mixed for other leading automakers in the U.S. EV market. While Chevy Bolt sales through May are up by 7 percent compared to the first five months of 2019, Nissan Leaf sales have fallen 46 percent. Audi continues to lead the non-Tesla luxury market and managed to sell 1,098 units of the new Q5 plug-in hybrid to supplement the steady performance of the e-tron, the second-most popular EV SUV on the market in 2020. Hyundai and Kia continue to hold onto a smaller segment of the market reporting gains for all models currently on offer through May.

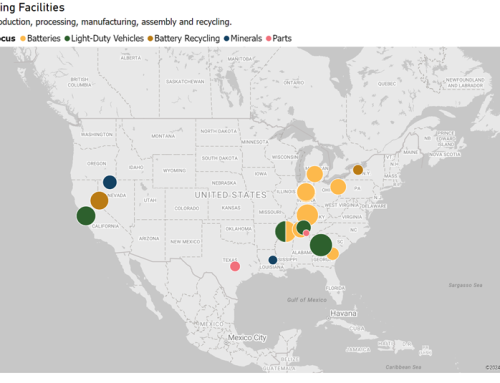

Tesla’s continued dominance has generated increasing pressure on other automakers to deliver on EV promises and breathe life into the market with a flotilla of new models. GM has redoubled their commitment to deliver 20 EVs across their brands by 2023 and provided more information for 12 models in the most recent sustainability report published on July 17th. At least five models will be introduced on the Cadillac platform, including an EV Escalade. The plans also promise a Chevy pickup truck with 400 miles of range, introducing another contender to the impending battle for dominance of the nascent electric pickup truck market.

New EV passenger pickups are just one aspect of growing government and private sector interest in truck electrification. Following the passage of the Advanced Clean Trucks Rule in California on June 25th, a coalition of 15 states has committed to 100 percent zero emissions truck and bus sales by 2050. Although a majority of participating states are also part of the ZEV Program, these transportation electrification leaders are joined by the non-ZEV states of North Carolina, Hawaii, and Pennsylvania. Many of the states in this coalition have the opportunity to award significant portions of their remaining VW Settlement allocations to support medium- and heavy-duty vehicle electrification. See how much each state has left to award in our latest data story on the VW Settlement.